Contents:

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. On the other hand, the highest point of the rebound following the first bottom is considered to be the trigger for the pattern. A horizontal line is drawn at the highest point of a rebound, called the “neckline”.

GBP/USD Forex Signal: Rising Wedge, Double-Top Form – MENAFN.COM

GBP/USD Forex Signal: Rising Wedge, Double-Top Form.

Posted: Thu, 30 Mar 2023 18:19:28 GMT [source]

After the top is created on the how to trade double bottom pattern forex, the pattern needs to create a bottom. Many times, this bottom could be located on a bullish trend line, but that is not a requirement. There are two things you need to do in order to identify the minimum potential of your Double Top/Bottom chart pattern. In addition, when you spot the Double Top or Bottom reversal pattern, you can use the structure to extrapolate how far the potential price move could go. After the creation of the second top, the price action drops and starts a new bearish trend.

Often, the second top won’t be quite as high as the first, as it’s signalling the end of buying pressure. Every week, we will send you useful information from the world of finance and investing. The pullback provides another entry point for people who have not opened a long position yet but are looking for an entry point.

Double Top Pattern • Double Bottom Pattern – Asia Forex Mentor

In this case, targeting a major resistance zone might make more sense. The reason some people are confused is that the double bottom occurs during a downtrend. The key thing to notice is that it occurs when sellers repeatedly fail to drive the price to a new low. Therefore, the double bottom has a characteristic “W” shape and signals a potential reversal to the upside.

As a result, the quotations drop, and the actual trend changes direction. The support level in this case is the low formed between the two bottoms. This is the starting point for trading and calculating the potential of the trade. A take-profit target is equal to the distance between the bottoms and the neckline and is set just from the neckline. A trader may use a trailing take-profit order if the market sentiment is bullish and there are fundamental factors that can push the price up. Hence, our entry is at $1.3110, a level where the USD/CAD closed above the neckline for the first time.

How to Confirm a Double Bottom Pattern

It will not only help you weigh up the risk against the potential reward, but it will also allow you to decide on a target price beforehand. This way, you can avoid making decisions out of frustration and closing your winning position prematurely. By using a stop loss order and a profit target you can easily circumvent this issue. And using a minimum RRR before opening the trade adds an additional layer of security – ensuring that the risk is worth the reward. Most people sitting on a winning trade get nervous that the market might reverse and take away whatever small profit they have on their position. They are very likely to close the trade prematurely and leave a lot of money at the table.

The exact level for stop-loss depends on your risk tolerance, but it can range from 15 to 30 pips below the neckline. Any move and close below the neckline invalidates the activated double bottom pattern. However, this proved to be a failed breakout as the price quickly returned below the neckline. This perfectly shows how important the virtue of patience is in trading. Moreover, this also shows why it is important to wait for a close above the neckline before entering the market.

Have it in mind that you need the right context and everything needs to line up for a trade-able setup. So, the first step is to identify the phase or market condition. At any given time the market can be trading either up, or down, or it can go sideways.

How to Identify Double Bottom Pattern

Trading FX or CFDs on leverage is high risk and your losses could exceed deposits. Here is an example on the CAD/JPY chart to show you how confluence trading works. So, while you should generally abstain from risking more than you stand to gain, the acceptable minimum RR will always depend on your strategy.

Is a double bottom pattern good?

A double bottom pattern is one of the strongest reversal patterns out there. Since it consists of two bottoms, it's not a very common pattern. Still, once identified, the pattern is very effective in predicting the change in the trend direction.

Between these two lows, there is a small upward correction, which gives the pattern the final look of the letter W. The trading volume – during the second bottom advance, it should be more significant than the first, showing the trend’s strength. A spike in the trading volumes indicates a higher demand and buying pressure, which confirms a successful double bottom chart pattern. It is common for the drop of the first advance to be around 10% – 20% and about 3% – 4% of the previous decrease. The second drop is formed as the market discounts the previous downtrend, and the buying pressure increases. As the second bottom forms, there are signs of a price reversal and uptrend.

The key limitation of the double bottom pattern is that it is a contrarian strategy. Don’t forget that the overall trend is bearish and we are playing the “long” trade here. Hence, the risk is always that the market will continue moving in the same direction. For this reason, it is important to consult supporting factors in the context of other technical indicators before entering the market. The trend is confirmed when the bullish trend breaks through the neckline level and continues upwards. Many traders will seek to enter a long position at the second low.

How do you trade double top and bottom patterns?

You can take a position on double tops and double bottoms with a CFD or spread betting account. These financial products are derivatives, meaning they enable you to go both long or short on an underlying market. As a result, you can use CFDs and spread bets during both a double top and a double bottom pattern.

For example, suppose a false breakout is identified at the right time – in that case, one can prepare to trade in the opposite direction, and go short instead. Whereas a double bottom pattern indicates a bearish-to-bullish trend reversal, a double top pattern shows a bullish-to-bearish change in the prevailing trend. A double top is a double bottom pattern in reverse and is set up according to similar principles. Leaving the trade early may seem prudent and logical, but markets are rarely that straightforward. The net effect is a series of frustrating stops out of positions that often would have turned out to be successful trades. You can take a position on double tops and double bottoms with a CFD or spread betting account.

Finally, it drops and reaches the initial level of resistance and then bounces back. Confluence can be found in all forms, limited only by your decision on which factors you deem important to consider. Price patterns, candlestick patterns, moving averages and trendlines can all be combined, just to name a few. The result is a complex trading signal that combines more than one trading technique to increase the odds of winning on a trade. This piece provided you entry and exit rules for trading forex double bottoms and forex double tops. Learn how to incorporate MACD divergence with these patterns to increase reliability.

Double Bottom Pattern Explained Trading & Technical Analysis – Finbold – Finance in Bold

Double Bottom Pattern Explained Trading & Technical Analysis.

Posted: Thu, 13 Oct 2022 07:00:00 GMT [source]

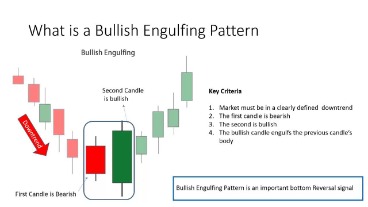

The double top pattern occurs when the price of a currency pair reaches a certain level and then declines. The price then rallies to the same level again and declines again, creating the appearance of a “M” shape on the chart. This pattern is considered a bearish reversal pattern and is often a signal to sell or short the currency pair. WebA double top pattern indicates that the uptrend may be ending, while a double bottom indicates that the downtrend may be ending. However, traders use them to make decisions, but sometimes, they can give false signals. In this course, we will discuss the double top and the double bottom patterns, explain what is each one, and how to trade them.

If it is – then the pattern is more significant and has more chances to work well. By the way – you get this sign even before second top has been formed. Another important moment is a trend shifting momentum while the second top is forming. Look, the market shows strong up bar when it moves to the second top, but right after that – a strong move down. Sometimes , it could look not only as long bars down, but as gaps also that is side-by-side to long down bars. Those who want to add to their positions buying up positions of the second group traders – who just scream “let me out” and those who just initially sold from some level.

So if you’re exited about https://g-markets.net/ double tops and bottoms and catching new trends, you’ll love this guide. Double Top A double top is a reversal pattern that is formed after there is an extended move up. The “tops” are peaks which are formed when the price hits a certain level that can’t be broken. After hitting this level, the price will bounce off it slightly, but then return back to test the level again. One helpful book recommendation on the topic of double top and double bottom patterns is “Trading Classic Chart Patterns” by Thomas Bulkowski. This book provides a comprehensive overview of these patterns, including how to identify and trade them, as well as their potential reliability and risk.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

The following chart shows a double top pattern in the EUR/USD pair. The actual pullback is shown in the red shaded rectangle , with line acting as the entry level. The second top of a double top and the second bottom of a double bottom pattern don’t have to form at the exact same level as the first top/bottom. Think about these prices as horizontal support/resistance zones and not as exact levels.

How do you trade in double bottom pattern?

- Identify a potential Double Bottom.

- Let the price to trade break above the previous swing high.

- Wait for a weak pullback to form (a series of small range candles)

- Buy on the break of the swing high.

Second, it is easy to incorporate other trading tools when using the double top and double bottom. As you have seen above, we have easily incorporated the concept of Fibonacci retracement. Also, it is relatively easy to use technical indicators like the Relative Strength Index , momentum, and the Relative Vigour Index . You have already begun to see how a structured approach can benefit your trading. We have showed you ways to manage your risk based on rational decisions and to establish profit targets. Another popular method to pick your double bottom pattern target price is through using the Fibonacci retracement tool.

This is something that needs to be backtested by a trader, in conjunction with your usual trading setup. This may also be known as a support level, depending on where you learned to trade. There are multiple very simple ways to trade a double bottom pattern. Let’s take a look at a few of the most popular ways that I also use myself to execute these trades.

When should I buy a double bottom pattern?

As the double bottom is formed at the end of the downtrend, the prior trend should be the downtrend. Traders should spot if two rounding bottoms are forming and also note the size of the bottoms. Traders should only enter the long position when the price breaks out from the resistance level or the neckline.